You can save energy and money by making a few simple changes in your home.

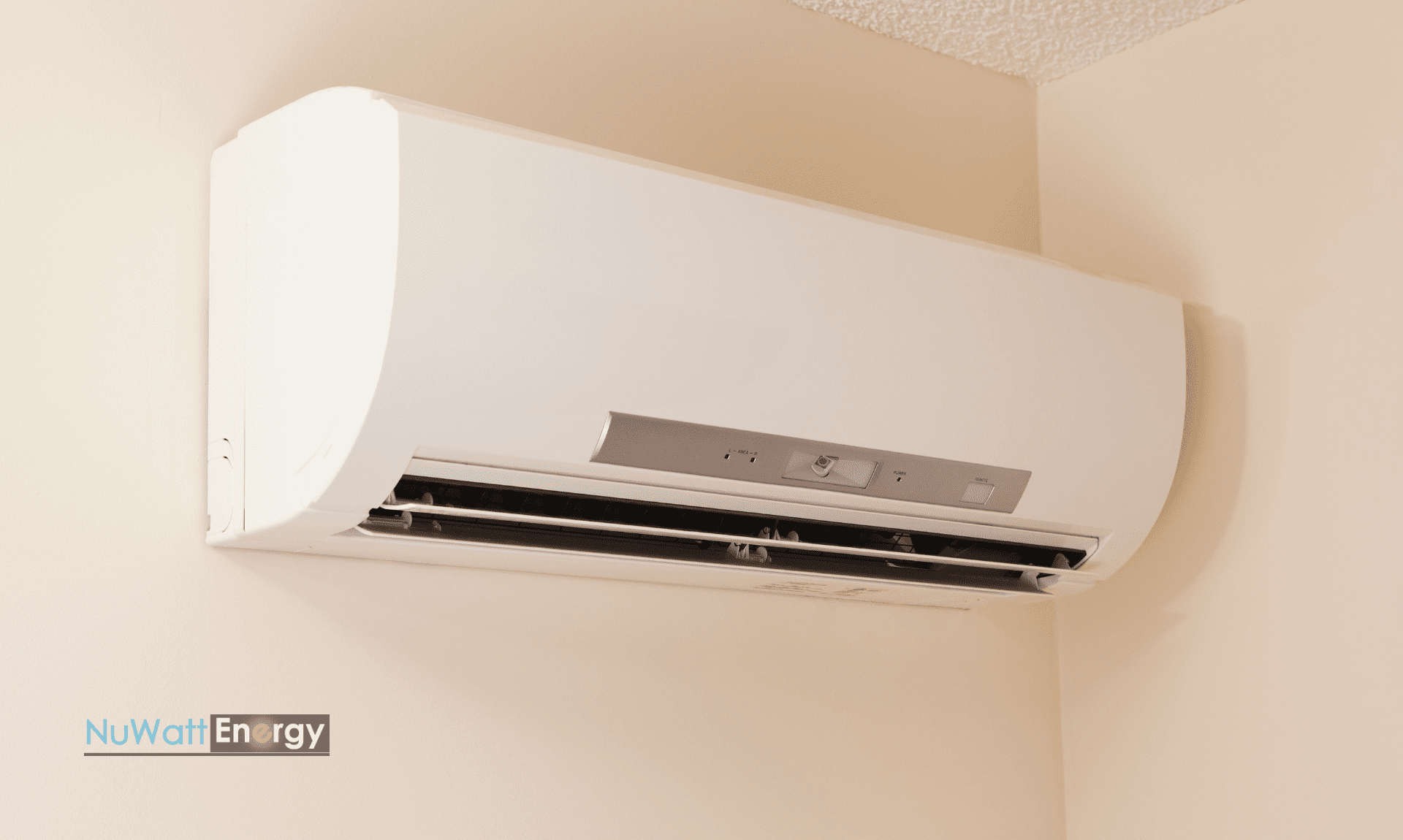

Try swapping out old lightbulbs for LEDs, weatherstripping around windows and doors, and installing smart thermostats. Consider more extensive improvements like air sealing, insulation, and HVAC equipment replacement for even better results.

Not only will these upgrades enhance your living space, but they can also increase the value of your home. Plus, by adopting energy-efficient practices, you're contributing to a cleaner environment and less strain on the power grid.

Some state governments and utility companies even offer incentives and rebates to encourage energy-efficient upgrades, so take advantage of these opportunities. It's a win-win for you and society.

We’ve put together a brief rundown of programs available for each state to make it easy to navigate the energy-saving programs available for your home.

Tap below to see the details for your state:

Okay, first things first: How do home energy rebates work?

And how can using a rebate to make home upgrades affect your average cost of utilities?

Getting a rebate for an energy-efficient home upgrade, like replacing your 20-year-old HVAC system with a heat pump, saves you money on your home appliance or service purchase. Then, the upgrades themselves go to work by reducing your overall energy usage.

And often, these home improvements can cut your usage significantly, especially when you invest in upgrading your home’s energy storage, installing professional EV ports, or replacing older appliances with energy-efficient ones.

Selecting the ideal air source heat pump system requires a holistic approach, considering factors beyond mere efficiency. Factors such as your home's size, layout, and regional climate must be considered to ensure optimal performance and comfort. Partnering with our experienced professionals ensures that you make an informed decision that aligns with your unique needs, maximizing the long-term benefits of your investment.

National government tax credits and rebates

If you own your home and want to reduce your carbon footprint, the government offers the largest tax incentives for qualifying HVAC equipment by opting for heat pumps. Starting in 2023, you are eligible for a federal tax credit covering 30% up to $2,000 of the heat pump cost and installation. This tax credit is capped at $2,000 per year.

It is recommended to spread out home improvements over several years to take advantage of annual aggregate limits. For example, optimizing attic insulation before getting a new air source heat pump is wise to avoid paying for excessive heating and cooling. Upgrading insulation and heat pump together in the same year can qualify you for a tax credit of up to $1,200 for insulation and up to $2,000 for the heat pump. You can combine a heat pump installation with window or door replacements to maximize your tax credits. Replacing your water heater the following year can benefit from an additional 30% tax credit of up to $2,000. You may also qualify for up to $600 in tax credits if you need an electric panel upgrade to accommodate the new water heater.

Energy efficiency requirements apply to split and packaged systems.

However, it's important to note that this credit only applies if the heat pump is installed to service an existing primary residence and not for new constructions or rentals. Annual aggregate and credit limits apply to claims for home equipment and improvement. You can claim up to $3,200 in efficiency tax credit in one year, the total annual limit.

Massachusetts Programs

Tap here to see the detailed guide on MA energy rebates, or scan the list below.

State-wide Programs

- Income Eligible Programs – homeowners may qualify for home upgrades based on your income level

PPL

- Weatherization, HVAC & Appliance Rebates – offers cash back when you purchase energy efficient HVAC equipment and appliances

PECO

- HVAC & Appliance Rebates – offers cash back when you purchase energy efficient HVAC equipment and appliances

- Income Eligible Programs – customers may qualify for a free home energy audit and other energy saving products like LED lights

MetEd

- HVAC & Appliance Rebates – offers cash back when you purchase energy efficient HVAC equipment and appliances

- Income Eligible Programs – customers may qualify for a free home energy audit and weatherization upgrades

Pennsylvania Programs

Get information on PA energy rebates by selecting this guide or scanning the list below.

State-wide Programs

- Income Eligible Programs – As a homeowner, it's possible that you could qualify for home upgrades based on your income level.

PPL

- Weatherization, HVAC & Appliance Rebates – You can receive cash back on your purchases of energy-efficient HVAC equipment and appliances.

PECO

- HVAC & Appliance Rebates – If you're buying HVAC equipment or appliances that are energy-efficient, you could qualify for cashback offers.

- Income Eligible Programs – You may be eligible for a complimentary home energy assessment and energy-efficient products such as LED lighting.

MetEd

- HVAC & Appliance Rebates – Investing in HVAC equipment and appliances that are energy-efficient may qualify you for a cashback reward.

- Income Eligible Programs – If you're looking to enhance your home's weatherization, you could be eligible for a free energy audit and upgrades.

Other state programs

DSIRE is a database of rebates and incentives for energy efficiency and renewable energy across the United States!

NuWatt Energy